2018 MAY BE REMEMBERED AS THE YEAR THAT THE SOFTWARE

As a Service or SaaS, business model truly came of age. Nearly a quarter of the technology companies to go public in 2018 were SaaS. Gartner recently projected that gross global revenue from SaaS will grow 17.3 percent in 2019 to total $206.2 billion. Furthermore, Gartner predicts that by 2021, 45% of all money spent on software will be spent on SaaS and that global SaaS revenue will grow to $278 billion.

Despite these promising forecasts, SaaS remains a relatively new digital business model. There is much confusion over which metrics are crucial to valuing a SaaS business, and which ones to focus on improving in order to drive real value.

Here, we examine the most important factors in driving value in SaaS businesses, with a particular focus on the metrics that the owner or management team should focus on.

SDE, EBITDA & REVENUE MULTIPLES

As with most any business valuation, the first step in determining the value of a SaaS business is to arrive at an accurate picture of earnings. The method used for coming to an earnings determination varies and is largely based on the size of the business.

For SaaS businesses with an estimated value of $5 million or less, Seller’s Discretionary Earnings, or SDE, is used almost exclusively. Above that and Earnings Before Interest, Taxation, Depreciation, and Amortization, or EBITDA, is most commonly employed.

In the case of rapidly growing SaaS companies that have yet to turn a profit—Dropbox, which successfully IPO’d in spring 2018, comes to mind—earnings may be less than zero. In this case, forecasts are made on the basis of revenue and growth. These projections tend to be more volatile than those produced by using SDE or EBITDA, as growth is notoriously difficult to predict with accuracy.

VALUATION DRIVERS

After an analyst determines the net earnings or revenue forecast of a SaaS business, the subsequent phase of the valuation process is to arrive at the multiple of earnings that will determine the asking price of the company. There are hundreds of data points to be considered—some of them common to any online business, and some unique to SaaS.

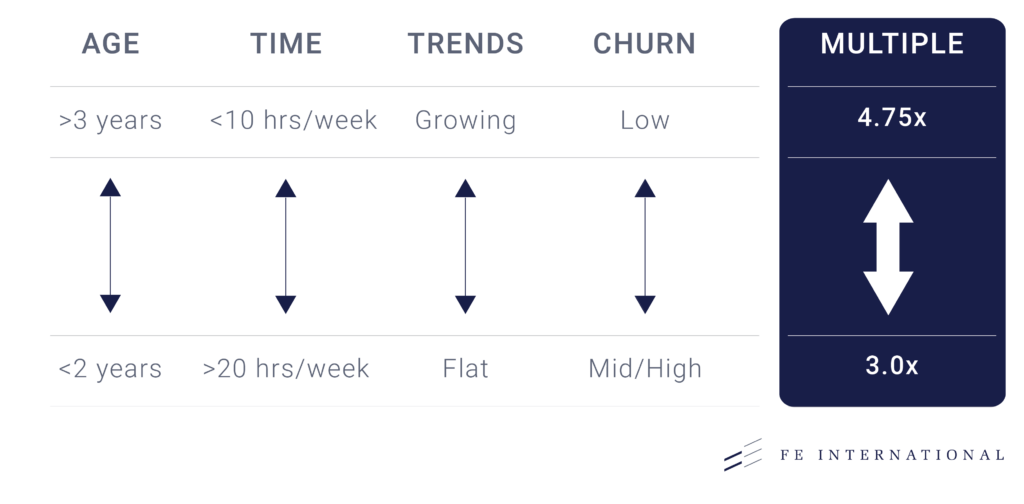

Most SaaS valuation drivers fit under one of three broad categories: transferability, scalability, and sustainability. This graphic shows some of the most crucial data points:

The four factors shown below are of utmost importance, and will likely have a significant impact on valuation, as shown.

- Age of the Business: A SaaS that has shown steady growth and stability over a period of 3 years or more will fetch a considerably higher premium than a younger business.

- Amount of Owner-Operator Time Required: Many, but not all, potential buyers of SaaS business are looking for relatively passive income. The less time a new owner is required to spend running a SaaS business, the higher the multiple it will fetch.

- Growth Trend: Unsurprisingly, SaaS businesses that have a track record of steady, sustainable growth are highly sought after.

- Customer Churn: The lower the rate of customer turnover—or churn—the higher the valuation.

CRUCIAL SAAS METRICS: EXPLAINED

Customer Churn

Customer churn is one of the most often cited metrics when valuing a SaaS business. The term is unique to subscription-based business models such as SaaS, but the underlying principle is almost universal. For a business to thrive, the number of new customers it acquires—or growth rate—should exceed the number of customers it loses—or churns—over the same time frame.

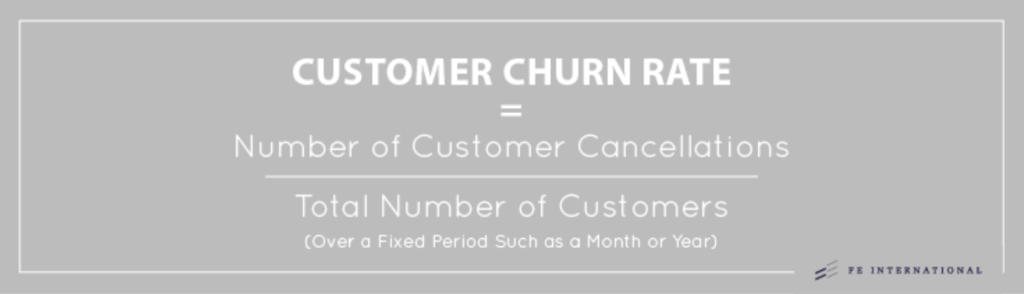

There are many nuances and variations in calculating the churn rate for a SaaS business, but the underlying formula is simple.

So, for example, a SaaS business that starts a month with 1,000 customers and ends it with 900 has a customer churn rate of 10 percent.

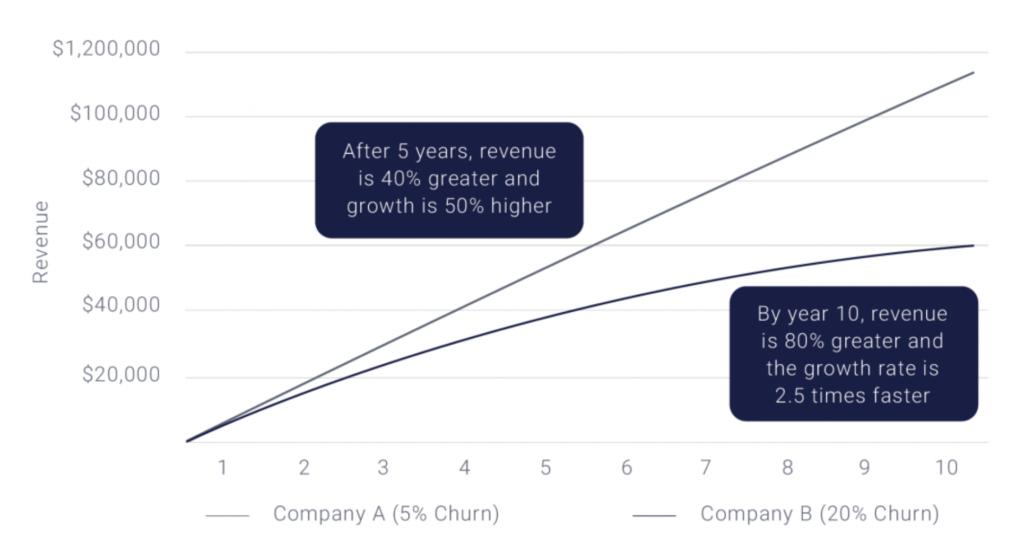

The impact that revenue churn (or the revenue lost through customer churn) can have on a SaaS business is substantial, as evidenced by the chart below:

The churn rate of a SaaS business is one of the valuation metrics that can be most positively impacted by owner action. Some of the ways SaaS business owners may be able to reduce churn include:

- Improving the onboarding process

- Building engagement with the SaaS through marketing emails promoting the benefits of the service, offering tutorials, etc.

- Monitoring usage and reaching out to customers who are not actively using the SaaS. Customers who aren’t utilizing a SaaS on a regular basis are highly likely to churn. Find out why they’re not engaged and take steps to address it.

- Actively harvesting feedback from customers who do churn, and using it to improve the SaaS product.

- Investing in paid digital advertising that targets those users who are likely to churn with a sequential series of ads that remind them of the benefits of the product and how they can solve the problems which caused them to sign up for the SaaS in the first place.

Customer Acquisition Cost and Customer Lifetime Value

Once development of a SaaS product is complete, and the product has been launched, one of the most significant expenses for many SaaS business is the cost of acquiring new customers. This Customer Acquisition Cost, or CAC, can be comprised of paid search or other advertising, the salary of a dedicated salesperson, or any other expenses directly related to landing a new customer.

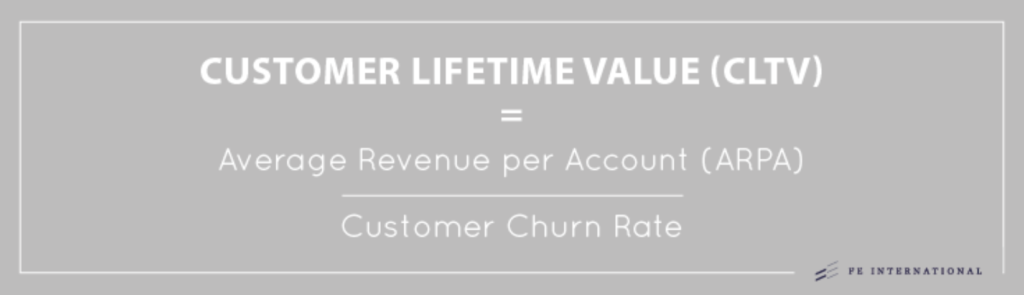

A company with a monthly marketing spend of $10,000 that acquires 50 new customers has a CAC of $200. The utility of CAC as a SaaS valuation metric significantly increases when it is measured in tandem with another crucial metric: Customer Lifetime Value, or CLTV.

CLTV uses churn rate and average customer revenue to calculate the total value of a customer to the SaaS business. CAC and CLTV are then compared to arrive at the CLTV to CAC ratio:

For large, well-funded SaaS businesses, CLTV:CAC ratio of 3:1 is often cited as being the goal to aim for. For smaller, bootstrapped SaaS companies, this level of marketing spending may not be sustainable due to cash flow concerns. For such businesses, a CLTV:CAC ratio of 2:1 or 1:1 is not uncommon. The lower the ratio, the higher the positive impact on the value of the SaaS. For more ways to market your SaaS take a look at these marketing strategy fundamentals.

Passivity Premium

Most investors looking to acquire a SaaS company are not looking for a full-time job, but many SaaS owners spend more than 40 hours a week on business operations. When the time comes to exit, the higher the level of owner involvement required, the lower the premium.

This is one crucial area that can be positively impacted by owner action. Before considering a valuation and sale, it behooves SaaS owners to examine any business processes that can be automated or outsourced. While it is in the nature of many entrepreneurs to take an “If you want it done right, do it yourself” attitude, this can be a handicap when it comes time to exit the business.

Finding experienced and talented freelancers through platforms like Upwork and Toptal has never been easier, and having an experienced and effective remote team in place for a new owner can significantly increase the transferability and value of the business.

Regularity of Subscription Revenue and Discounting

When it comes to valuing a SaaS business, not all types of subscription revenue are created equal. Buyers and investors in SaaS businesses have a strong preference for Monthly Recurring Revenue. In fact, it is typical to value MRR at twice the revenue rate of lifetime plans. To receive a premium valuation, a SaaS business should aim for a ratio of 4:1 MRR to Annual Recurring Revenue (ARR).

The disparity in value between MRR, ARR, and Lifetime plans is one of the primary reasons that SaaS businesses should avoid discounting at all costs. While offering a reduced rate on ARR or lifetime subscriptions may result in a short-term boost in revenue and user base, it has a detrimental effect on long-term value.

Comprehensive and Verifiable Records

One common mistake SaaS business owners make, particularly in the early days, is the failure to keep comprehensive and verifiable records of financials and traffic. Both are not only invaluable when preparing a SaaS business for a sale, but they are also critical for monitoring and improving performance.

Thankfully, maintaining meticulous financial records is no longer the onerous task it once was. Accounting software like Quickbooks and Xero sync with your bank accounts and eliminate much of the drudgery of traditional bookkeeping.

For a SaaS business, accurate financials are not the only records needed to achieve a favorable valuation. Internet traffic is the lifeblood of most digital businesses, and this is typically true for SaaS. At a bare minimum, a SaaS business should maintain records of traffic through Google Analytics. SaaS businesses that rely heavily on organic and paid traffic for new customer acquisition may want to consider employing more sophisticated analytics tools such as Piwik or Kissmetrics.

Follow Coding Best Practices

Code is the backbone of any SaaS business. Following contemporary coding best practices will facilitate updating the SaaS or fixing any issues that may arise. A SaaS with clean code that is thoroughly annotated will tend to fetch a higher premium.

Secure Intellectual Property

Any intellectual property (IP)—such as trademarks, copyrights, and patents—should be registered with the appropriate authorities and easily transferable to a new owner.

Product Lifecycle

Virtually any digital business requires regular updates to maximize performance and reliability. SaaS businesses that are in the mature phase of the product lifecycle and not in need of an imminent overhaul will receive a higher premium.

Don’t Get Too Technical

SaaS founders often write their own code, but many buyers looking to invest in a SaaS business classify themselves as non-technical. This is another area where outsourcing can pay dividends. Having a reliable and affordable outsourced development option in place will increase the pool of potential buyers and therefore result in a higher premium.

FINAL THOUGHTS

The SaaS business model has been embraced by everyone from tech giants like Microsoft and Adobe to bootstrapped founders toiling away in their bedrooms. The prospect of regularly recurring revenue and steady, predictable growth has also made SaaS highly appealing to investors and those looking to purchase a profitable business. By proactively addressing the factors described above that drive real value, owners can dramatically improve the value of their SaaS business. If you are interested in a free valuation for your SaaS business, please complete this short form and we will be in touch.

Citations:

“Gartner Forecasts Worldwide Public Cloud Revenue to Grow 21.4 Percent in 2018.” Gartner IT Glossary. Accessed January 10, 2019. https://www.gartner.com/newsroom/id/3871416.